Newsroom

Click here to go back

Web Organizers & Uploading Files

Are you using your client portal this tax season? Here's a few things you should know:

It's easy to access right on your client portal homepage. Once you have completed filling out your organizer, just click 'Submit to Preparer'. Our office will then get a notification and start working on your returns! You can upload tax documents as you fill out your organizer, but there is a catch...

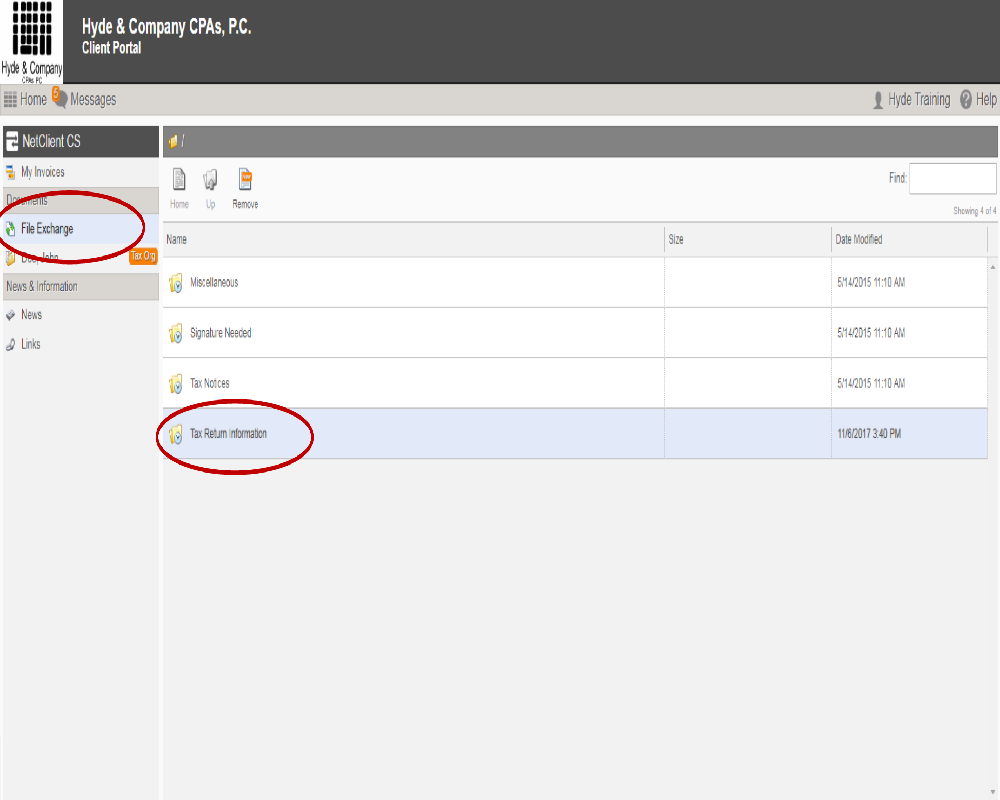

If you upload documents but don't click 'Submit to Preparer' we won't know that you did it! If you are not filling out a web organizer, we recommend you upload all documents via File Exchange (see below). That way, we'll know when you've uploaded a file for us to see!

If you have any questions for us don't hesitate to give us a call! And remember to follow us on social media for all of the latest updates from our firm.